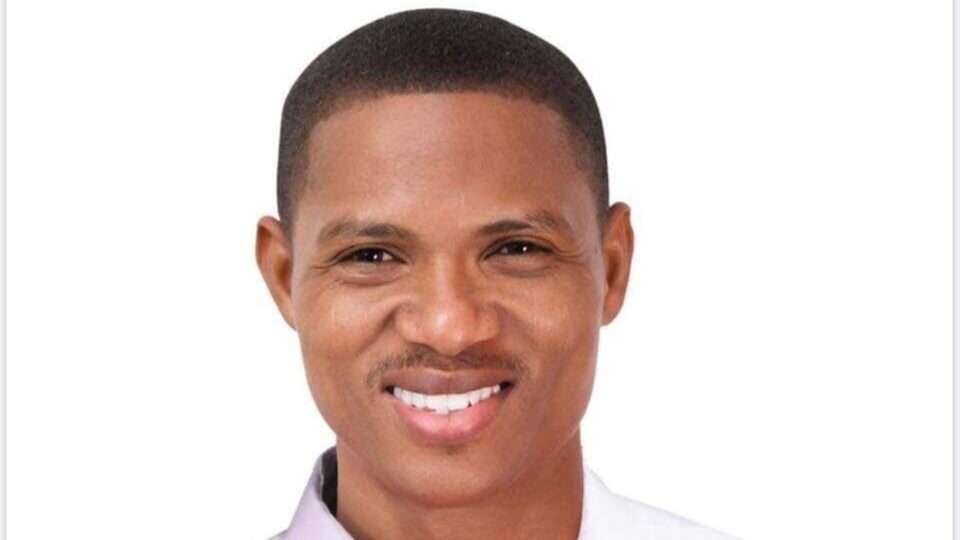

The Member of Parliament for Madina, Francis-Xavier Sosu and four other MPs, have introduced a private member’s bill in Parliament to repeal the 10% withholding tax on winnings from betting and gaming.

In a letter dated November 7 to the Clerk of Parliament, the MPs highlighted the importance of this move, citing the current economic difficulties and the need for policies that alleviate the financial burden on Ghanaians.

They argued that the tax on gaming winnings exacerbates financial challenges and limits the economic choices of citizens, especially in light of the economic impact of the Domestic Debt Exchange Programme (DDEP).

“Considering the impact of the Domestic Debt Exchange Programme (DDEP), and the related exacerbation of the twin challenges of unemployment and economic hardships, as well as the seeming lack of adequate safety measures to cushion vulnerable Ghanaians against daily pressing needs.

“There is, therefore, an urgent need to introduce programmes, including tax policies and measures that seek to rescue Ghanaians in light of the harsh economic realities, reduce the cost of living, promote savings and investments, and achieve economic stability and sustainable growth, hence this Bill.”

The withholding tax on gaming winnings, implemented by the Ghana Revenue Authority (GRA) on August 15, 2023, applies to all gross gaming winnings at a rate of 10%.

This tax, which replaced the former 15% VAT on each stake, was introduced in line with the amended Income Tax Act, of 2023 (Act 1094).