In an unexpected move, promoters of the aborted Agyapa royalties deal, have begun disclosing the names and payments of individuals involved in the flawed transaction under the Akufo-Addo government.

The revelations go beyond what was initially disclosed by the Chief Executive Officer (CEO) of the Minerals Income Investment Fund (MIIF), Edward Nana Yaw Koranteng, to the Public Accounts Committee (PAC).

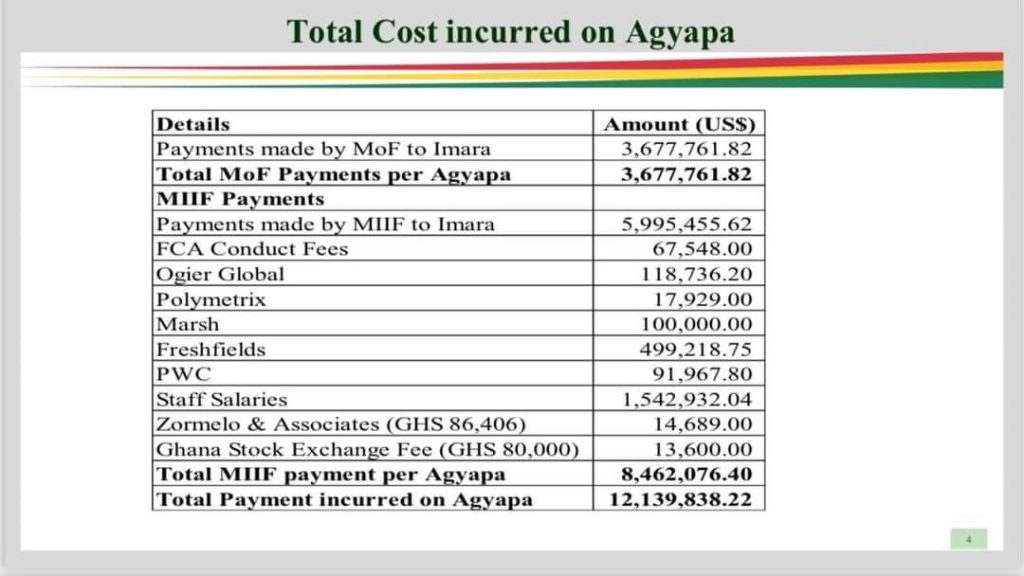

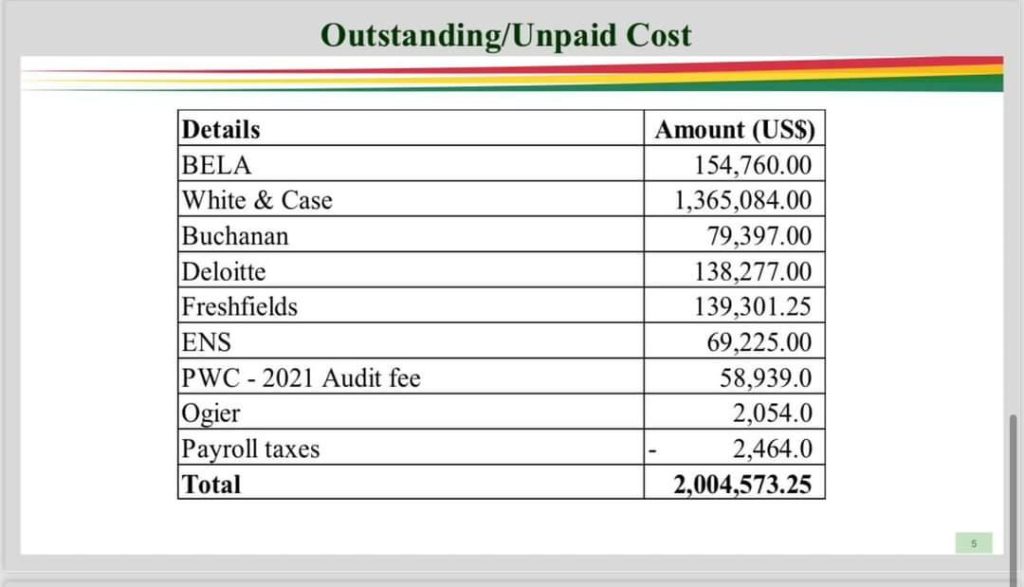

The actual cost of the deal is now reported to be a staggering US$14.144 million, contrary to the previously communicated US$12 million.

With $12.139 million already disbursed, there remains a lingering balance of $2.005 million, prompting concerns about the financial implications and potential consequences surrounding the controversial deal.

Another strange thing about the transaction nicknamed “Project Kingdom Advisors” is the names of Ken Ofori-Atta’s Databank Financial Services and Africa Legal Associates, a law firm owned by President Akufo-Addo’s cousin, Gabby Asare Otchere-Darko, are missing from the slides that went out last week detailing those who participated in the attempt to collateralized the country’s mineral resources.

In the past, Ken Ofori-Atta, while serving as Finance Minister, had mentioned his company Databank and Gabby’s Africa Legal Associates as involved, while struggling to douse conflict of interest tag in the transaction.

The two could be hiding behind Imara Holdings of South Africa and the UK-based law firm, White & Case, respectively.

They run partnerships. Indeed, on the website of Imara Holdings, Databank is identified as its partners in Ghana. Africa Legal Associates, has also had public dealings with the White & Cash law firm, and Gaby confirmed this to The Herald.

The disclosed actors in the deal as captured by the slides, include Imara/Algebra as the Transaction Advisor, Amber as the Ghana Sponsor Broker/Bookrunner, White & Case as the UK Legal Advisor, and Accra-based Bentsi-Enchill, Letsa & Ankomah (BELA) as the Ghana Legal Advisor.

Jersey Legal Advisor was mentioned as Ogier, SRK as the Technical Advisor, and Deloitte served as the Reporting Accountant and Tax Advisors.

Marketing and PR, were handled by Buchanan/Red Sky, ESG by Critical Resources, and International Bookrunners were BofA/BMO/JP Morgan.

ENSafrica provided Legal counsel to Bookrunners, Kom Ferry acted as recruitment advisor, and Deloitte again served as the Remuneration Advisor.

Payments, mostly in United States dollars, were made to these entities, with Imara Holdings alone, pocketing almost US$10 million as transaction advisors. Staff salaries for a deal that faced setbacks consumed over US$1.5 million.

Other companies mentioned in the slides, include Ogier Global, Polymetrix, Marsh, Freshfields, PWC, and Zormelo & Associates, among others.

The Mines and Energy Committee of Parliament, has formally requested detailed information and supporting evidence from MIIF regarding the reported government expenditure of $12 million on the Agyapa Royalties deal. The committee’s request, follows a disclosure by MIIF CEO, during an appearance before PAC.

In response to the public discourse surrounding the alleged expenditure, the committee seeks guidance on appropriate steps to take.

MIIF has been directed to furnish the committee with relevant information by Tuesday, February 27, 2024. The purpose of this request is to guide the Select Committee on the appropriate steps to take in respect of the claims.

Amidst these revelations, concerns persist regarding potential conflicts of interest, particularly about Gabby Asare Otchere-Darko’s Africa Legal Associates.

Gabby’s link to the Agyapa deal aside Ken Ofori-Atta, got a mention, Abdul Malik Kweku Baako, in a spirited defence, insisted that Africa Legal Associates, an Accra-based law firm owned by Gabby Asare Otchere-Darko, was not paid US$2 million for its work on the Agyapa Royalties deal.

The figure was bandied about nearly four years ago by some persons as the amount Gabby and his firm grabbed for their advisory role on the deal. But Baako, claimed the quoted amount was way above what was paid to the law firm by the government.

“It is not true that Gabby’s firm got US$2 million from the deal. It is not true that his firm is a beneficiary of US$2 million. It’s not even up to US$105,000. It is the main transaction advisor that paid Gabby. It is about US$103,000. It is not US$2 million”, the editor-in-chief of the New Crusading Guide newspaper had insisted.

Ken Ofori-Atta’s company, Kweku Baako Jnr, further insisted that Databank had as of November 2020 not received any payment for their role as financial advisors in the Agyapa Royalty agreement.

This was after it was publicly held that the investment bank which is owned by Finance Minister Ken Ofori-Atta, enjoyed monetary benefit from the deal.

In February 2021, the investment and brokerage firm, Databank served notice to Imara Holding Limited of their decision to withdraw their services as a partner and transaction advisor in the controversial Agyapa royalties deal.

Databank and Imara Holding Limited were co-partners and transaction advisors for the Agyapa Gold Royalties Company.

According to the Group CEO of Databank, Kojo Addae-Mensah, in a letter to Imara Holding Limited, he stated that their decision to withdraw, follows several attacks on their reputation by political actors as a result of the Finance Minister’s association with the investment firm.

This he says was intensely felt during the just ended 2020 elections.

“The Board of Directors of Databank has observed with deep concern persistent attempts by some political actors, during the political season leading up to the general elections of December 2020, to tarnish our hard-won reputation painstakingly built over the last 30 years, by unfairly exploiting our participation and involvement in the transaction as one of the transaction advisors. We believe this is principally due to the Minister of Finance’s association with Databank as its co-founder.”

He added that despite the great rewards they are certain the country would benefit from the said transaction, the insinuations made against the brokerage by these political actors “not only grossly compromise the ability to execute such a market-sensitive and novel transaction, but also has a real tendency to severely damage the invaluable business reputation of Databank.”

He further explained that the bank’s decision to withdraw was an attempt to salvage the hard-earned reputation they had painstakingly built over the last 30 years.

“It is this deep market knowledge and extensive experience that makes us understand that the potential damage from the fall out of all the negative press regarding Databank’s involvement in the Agyapa transaction, especially the proposed IPO, despite our sterling track record over the years, is incalculable both in the domestic and international financial markets.”

“The reasons expressed above have compelled us to take the hard-decision to formally withdraw our services as your partner and co-transaction advisor on this mandate.”

In March 2021, Ken Ofori-Atta, then Finance Minister-designate, disclosed that the main reason why Databank pulled out of the Agyapa royalties deal was as a result of controversies that were circulating through the media.

Ken, told Parliament’s Appointment Committee, Friday March 26, 2021 that he was taken aback when the investment bank [Databank] issued a letter expressing its withdrawal from the deal.

He said the media controversies which he termed as ‘noises’, did not help Databank thrive as a corporate entity.

“And I believe that they thought if their presence was going to be inimical to the realisation of this vision which they believe in, then it’s better to step out to avoid that noise,” adding as a nation, the effect of such deals on companies should be stated clearly for companies competent enough to take Ghana to the capital market.

“I’m sure you [Mubarak Mohammed Muntaka] have Databank’s letter and, therefore, reasons ascribed to that are clear. And I think one of those was that they were not going to be standing in the way of a deal that they thought was good for the republic.

“And if their exit would enable the transaction to go on, then they’d rather do that,” Ken Ofori-Atta said.