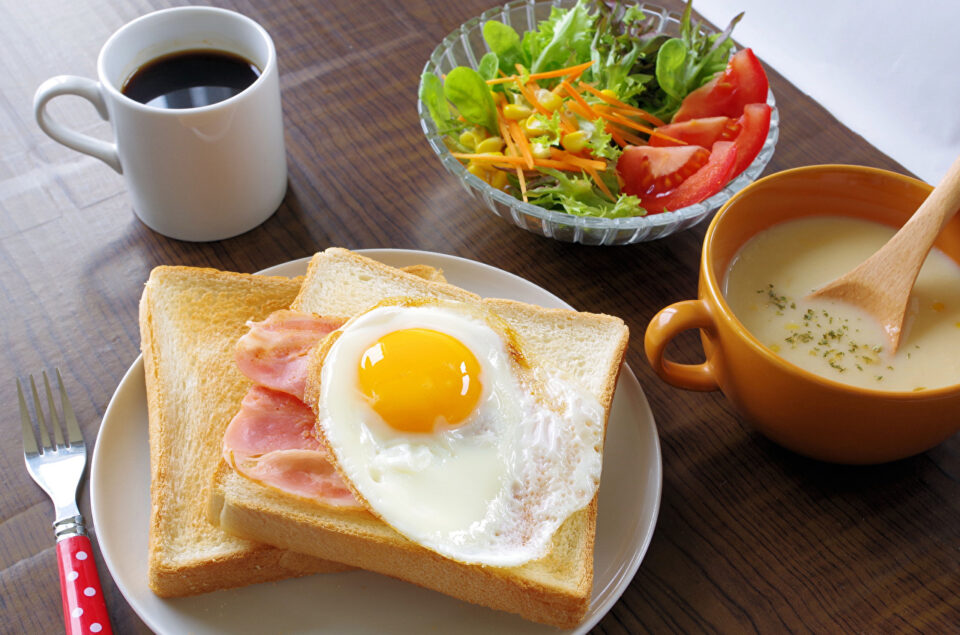

Economist Dr Evans Nunoo, says it doesn’t make economic sense for someone who earns between GH¢1,000 and GH¢2,000 to be taking tea, bread with eggs and salad.

January, the first month of the year, is often observed as a difficult period in relation to personal financial management.

The current unstable economic environment makes the situation dire.

To effectively manage one’s current financial situation, consumers are advised to assess their assets and obligations to make informed purchases.

Dr Evans Nunoo, gave the advice when he spoke to David Akuetteh on Luv-in-the-morning.

The topic was ‘how to survive on a salary of GH¢1,000 to GH¢2000’.

“Two thousand Ghana cedis is a small amount, if you look at our current economic situation.

Nunoo also advised on multiple bank accounts for expenditure and projects.

“If you are expecting multiple streams of income, you are tempted to have more bank accounts. If you want to work harder and be financially strategic, it is better to keep more than one bank account.

It is not as if, if you are having only one bank account, you are making a mistake or not working hard.”

Economists are advising that not more than 50% of personal monthly income should go towards debt repayment.

Nearly every Ghanaian carries some kind of debt.

But many wonder how much income should be allocated towards paying off credit cards, car loans, student loans, or mortgages.

Generally, the rule to follow is to pay as much as you can each month in excess of the minimum required payment for the loan.

Evans Nunoo also outlined what he described as unnecessary expenses for the year 2023.

“You should not spend because you want someone to see you as a good person. You should not spend just so people will see you are of a certain social standing.

You don’t spend because others are spending,” he explained.