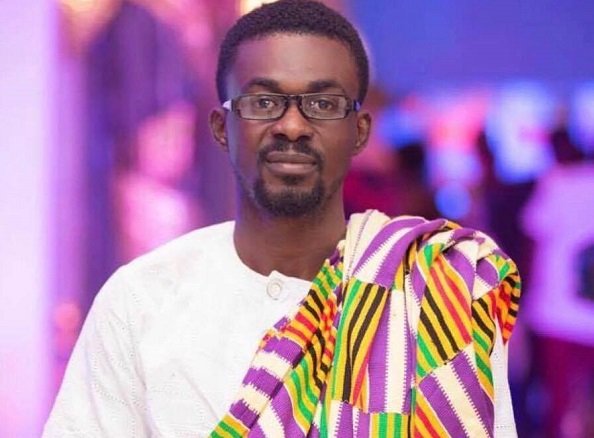

Embattled Chief Executive Officer (CEO) of Menzgold Ghana Limited, Nana Appiah Mensah has made his 36th appearance in court without trial as his case has been adjourned again to September 20, 2023.

Nana Appiah Mensah popularly known as NAM1 was initially charged with some 13 counts but that had since been amended and his plea on the amended charge sheet filed on September 3, 2019, which introduced some 61 new charges is yet to be taken.

In court on Wednesday July 26, 2023, when NAM1 was making his 36th appearance without trial, as the police requested for more time.

“The Docket has been forwarded to AG’s Office and we since not receive any response or advice from the officer of the AG,” ASP Haligah said, “we are still waiting for attorney generals response.”

The Circuit Court presided over by Her Honour Mrs Evelyn Asamoah has since adjourned the matter to September 20, 2023.

The CEO of Menzgold made his 30th, 31st, 32nd, 34th, 35th and 36th appearances on November 9, December 14, both in 2022 and January 2, April 24, June 8 and July 25, 2023 respectively.

From July 12, 2019, the CEO of the gold dealership firm has trekked court at least 36 times as of today, July 26, 2023.

Previous appearances

EIB Network‘s Murtala Inusah who compiled the number of times NAM1 had appeared in court since July 12, 2019, said, the businessman would make at least his 36th appearance on September 20, 2023.

In 2019, NAM1 made six appearances at the Circuit Court in Accra while in 2020 he appeared in court eight times. He then made further nine appearances in 2021 and five times in 2022.

For 2020, the CEO of Menzgold made appearances on January 21, March 6, June 24, July 20, September 7, October 1, November 4 and December 16.

In 2021, NAM1 made nine appearances on January 20, March 2, April 1, May 27, July 6, September 2, October 11, November 22 and December 21.

Meanwhile, he had also made court appearances in a Dubai Court prior to his return to Ghana following the collapse of Menzgold.

Main trial

On August 17, 2019, the embattled NAM 1 was released from police custody after meeting his varied bail conditions.

NAM1 together with his wife Rose Tetteh and his sister Benedicta Appiah (both at large) were facing a total of 13 counts of defrauding by false pretences, money laundering, abetment and carrying on deposit-taking business without licence.

On July 26, 2019, NAM1 pleaded not guilty to all the charges and the court presided over by Jane Harriet Akweley Quaye granted him bail to the tune of GH¢1 billion (about $185 million) with five sureties, three of which are to be justified.

Additionally, he was ordered by the court to report to the police every Wednesday.

But the condition that required him to ensure three of the five sureties provide justification was removed when he could not meet his initial bail terms.

Charges

The initial counts preferred were defrauding by false pretences, abetment to defraud by false pretences, carrying deposit business without licence, abetment of sale of minerals without licence, sale of minerals without licence, abetment of unlawful deposit-taking, unlawful deposit-taking and money laundering.

Brief facts

The brief facts of the case as presented to the court by then ASP Asare, (now Superintendent Sylvester Asare) were that in October 2018, the police received a complaint from about 16,000 people that Menzgold had convinced them to invest GH¢1.68 billion in a gold purchase scheme that yielded 10 per cent monthly interest.

ASP Asare told the court that, the complainants said their money was locked up and they could not find Mensah and the other principal officers of the company.

He said investigations revealed that Menzgold and Brew Marketing Consult were incorporated as limited liability companies in 2013 and 2016, respectively.

DSP Asare (now said Menzgold obtained a licence from the Minerals Commission in August 2016 to purchase and export gold from small-scale miners, and that in order to successfully engage in the business, Nana Appiah founded Brew Marketing Consult to be a gold buying agent.

DSP Asare said although Menzgold was licensed to purchase gold, it was not licensed by the Minerals Commission to trade in gold.

Notwithstanding the lack of such a licence, he said, Menzgold went public after its incorporation and invited the public to deposit money for a fixed period with interest, on the pretext of gold purchasing.

He said further investigations revealed that the three accused persons were the directors and principal officers of Menzgold and Brew Marketing Consult.

Source: starrfm.com.gh