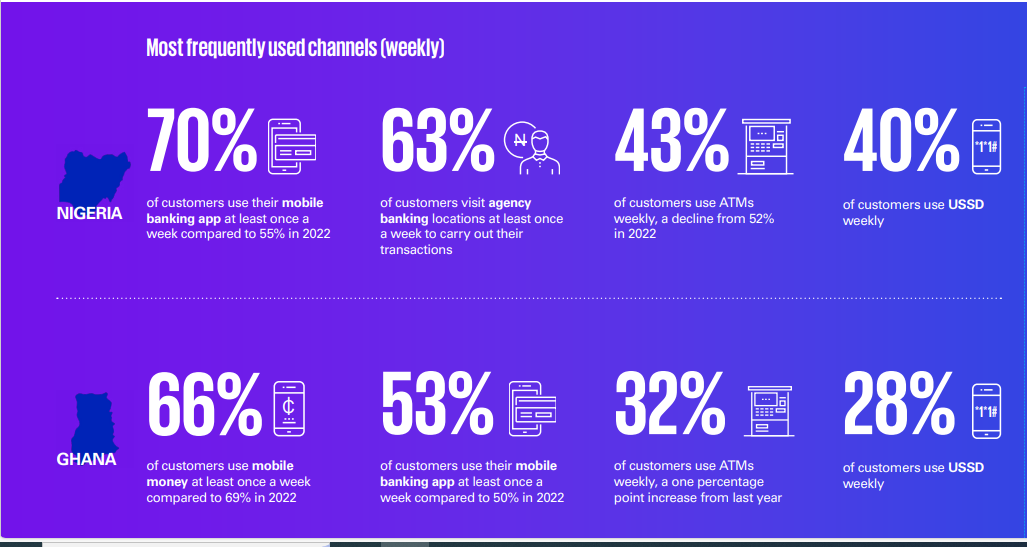

The payment system in Africa appears to be advancing, with Nigeria leading the mobile banking app chart with 70%, and Ghana trailing with 53%, according to the 2023 West Africa Banking Industry Customer Experience Survey by KPMG.

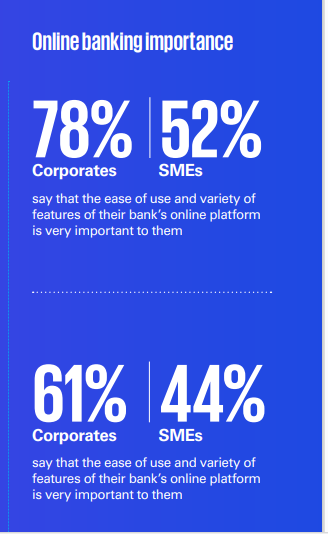

The research highlights diverse value-seeking behaviours across customer segments.

The research is KPMG West Africa’s inaugural combined customer research—the 17th consecutive edition in Nigeria and the 4th in Ghana.

KPMG explained that the research explores parallels across both markets, such as the acceleration in digital adoption, and distinctive local nuances, such as high mobile money penetration in Ghana, and the growing role of fintechs in the Nigerian banking landscape, underscoring the uniqueness and intricacies of each market’s landscape.

KPMG, in its survey, disclosed that 70% of customers in Nigeria use their mobile banking app at least once a week, compared to 55% in 2022.

In Nigeria, 63% of customers also visit agency banking locations at least once a week to carry out their transactions.

However, 53% of customers in Ghana use their mobile banking app at least once a week, compared to 50% in 2022.

66% of customers in Ghana also use mobile money at least once a week, compared to 69% in 2022.

“This year, the Nigerian banking industry recorded marginal increases in overall customer experience ratings across the retail and corporate segments compared to 2022. Retail banking experiences improved by over three percentage points, the highest score in the last five years. However, the SME segment experienced a slight decline of just over one percentage point compared to the previous year.”

“In Ghana, overall customer experience performance in the retail segment improved this year by

approximately four percentage points over last year’s score. The assessment of banks across all segments this year gives a more nuanced view of banks’ performance.”

On the digital trends, KPMG in its survey said Mobile connectivity soared, exceeding 100% in Ghana and Nigeria.

“The evolving digital landscape in West Africa is dramatically altering its financial ecosystems. Mobile

connectivity has soared, exceeding 100% in Ghana and Nigeria. This surge has sparked a profound shift in the payments sector.”